Investing in Innovation: A Conversation with Tamara Steffens

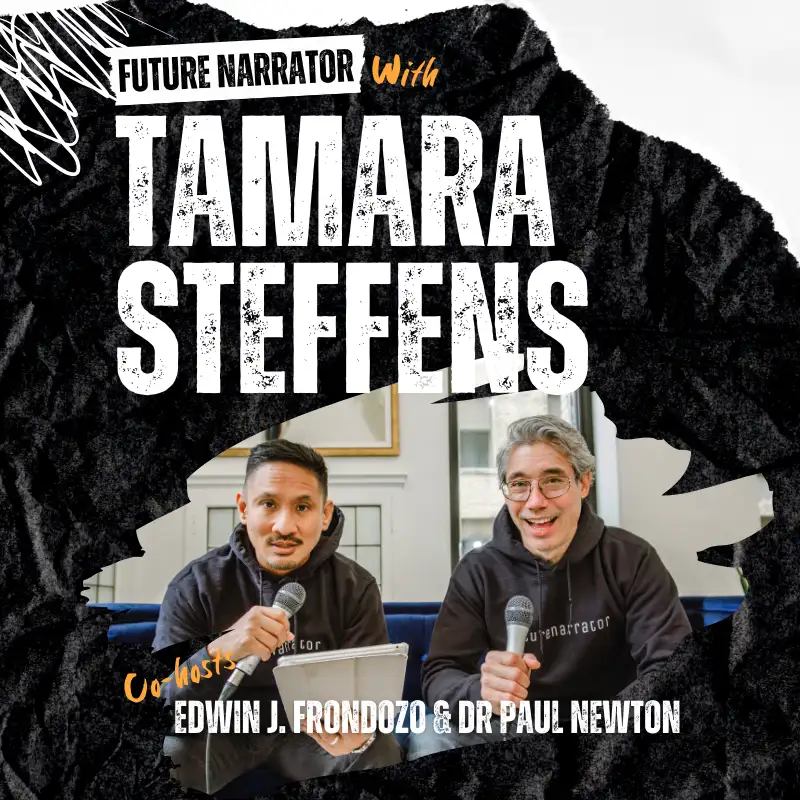

You are listening to the Business

Leadership Podcast with Edwin.

Paul: Hello.

Hello.

I'm Paul Newton, creative producer

of the Future Narrator miniseries,

and I'm joined by Edwin Fonzo, host

of the Business Leadership Podcast.

We are recording live at Web Summit

Vancouver 2025, where we're exploring

how today's leaders shape the future, not

just through strategy, but through story.

We believe that a strong point of

view is what inspires communities,

builds movements, and cuts through

the noise in uncertain times.

So let's dive into this conversation.

Today's guest is a powerhouse

at the intersection of

startups, strategy and scale.

Tamara Steffens is the managing director

of Thomson Reuters Ventures, where she

leads a hundred million dollars strategic

fund investing in early stage companies,

shaping the future of enterprise tech.

In just three years, she's helped turn the

firm into one of the most active corporate

venture funds in North America and beyond.

A seasoned operator and investor

Tamara has contributed to multiple high

profile exits, including software.com

and Boingo, both IPOs and acquisitions

by Microsoft, apple, and Cacao Talk.

Before helping found Thomas Reuters

ventures, she led investing and VC

partnerships at M 12 Microsoft's

Venture arm and currently serves

on the National Advisory Council

on Innovation and Entrepreneurship

under the US Secretary of Commerce.

If you're building at the edge

of innovation or investing at

the heart of it, you're going to

want to hear what she has to say.

Edwin: Welcome to the

Business Leadership Podcast.

Tamara: Thank you for having me.

Delighted to be here.

Edwin: I'm super excited to have

you and really to sit down and,

but just, just to get started, um.

We're in day two here

at Web Summit Vancouver.

Um, not sure how, how's

your week going here so far?

Tamara: So far great.

We've met tons of great founders, uh,

lots of new startups in our, in our thesis

or in our categories that we look at.

So excited to be here.

We're Canadian, right?

So Thompson Reuters, yes.

Is based in Toronto.

So we are excited to come over to

Vancouver, obviously for better

weather yesterday, which was nice.

It was

Edwin: amazing.

Um,

Tamara: but yeah, so excited to be

here, meet both Canadian and us.

Based founders.

Um, so it's fun.

Edwin: Yeah, no, it's fun.

And uh, it's funny, I meet other

fellow people from Toronto and I'm

from Toronto, so it's, it's nice

to converge here in Vancouver.

Where, where, where all the

innovation's happening in the startups.

Um, can you, I guess

let's just get started.

For those who may.

Be listening, may not know.

Tell us about Thomas Reuters

ventures and really the problem

that it's looking to solve with

the early stage venture investing

and within enterprise innovation.

Tamara: Yeah, so it's great.

Thomson Reuters, um, we started

our venture fund three years

ago and, you know, new news, we

actually have a second fund now,

so we're actually 250 million Yay.

Under management, which is exciting.

Mm-hmm.

We, we announced it, um, just recently.

Okay.

So it, it's hot off the press.

Um, so, uh, we try to

invest in things we know.

So we're not, we do, we invest from a

financial lens, so we want return on

investment, so we no different than any

other venture fund that wants return.

So that's how we look at things

and why we invest, but we tend

to invest in things we know.

Right.

Mm-hmm.

So legal tax, FinTech, things

on the periphery of that.

Certainly some media because of Reuters.

Um, but you know, we, we don't like

to invest in things we don't know.

Right.

So that's our strategy.

Edwin: Oh, that's amazing.

And when it comes to, I guess, your

position and being the managing director,

I'd be curious now, given your track

record, where you come from and, and

being within the investments, uh.

Business.

Um, what's your unique point of view

now that you bring to the firm and

also to, to the portfolio companies?

Tamara: Yeah, I don't, you know, I

actually don't think it's changed much

over the years because I did six startups.

Um, I tend to have a lot of

empathy for founders right there.

There's always, um,

changes, potential pivots.

Um, it's a rollercoaster to ride, to get

on to begin with, to start a company.

Um, it's hard.

Um, and any founder who takes that risk

and that journey, um, I like to try to be

there for them because I've done it right.

I've seen the ebbs and flows

of, of being in a startup.

And so if I can be one of the people

on the team, uh, of investors.

Um, one of the sane board members

that understands there's bumps.

Um, then I like to offer that.

Paul: Yeah.

So having done it six times, what, like

what do you really care about here?

Tamara: Well, uh, now I'm on the

other side, so I do care that

we get a return on investment.

Mm-hmm.

Course.

So I wanna see the founder succeed.

I wanna make sure that they understand

what an exit looks like, you know, and

there's multiple ways to exit, right?

They can go public, they can

sell, um, they can merge.

So there's a number of different.

Um, paths they can take and as

we hopefully go that journey,

go down that journey together,

I can give them some guidance on

what is the best path for them.

I mean, everybody wants

to go public, right?

Generally speaking, that

would be the, the greatest.

Um.

Exit, right?

Should be, but it's not always right.

Sometimes it is better to sell the

company and I've had a chance to do both.

Right?

software.com

went public in 99, um, but we sold

a Comple, which was my last startup

to Microsoft at the end of 90, or

at the end of, uh, 2014, right?

Both great outcomes.

Um, and in the end really.

Either way would've was fantastic.

So I think sometimes people think we're

gonna IPO and that's the direction we have

to go, but if you get the right offer and

you can exit earlier with less stress.

Um, I say take that route if you can.

Paul: Yeah.

And so having, having experienced the,

the different ways out, um, how do

you, how do you guide, uh, guide people

to, to exploring or, or getting ready

for the outcomes that are possible?

Tamara: Yeah.

It's a much longer journey

to go public, especially now.

Um, back, you know, when

we took software.com

public, it really was.

You could have significantly less

revenue than you have to have today,

I think, to be successful at an IPO.

Um, so it was a, you know, granted it,

it was a while ago, but, um, I think

getting to that level of revenue and

that consistency to be able to put

string together six or eight quarters

as a public company is difficult, right?

So it's not something you can do

in four or five years, um, which

we were able to [email protected].

It.

Probably not five years, probably seven.

But um, if you think about it

now, it's just a longer journey.

So if, if you can exit for the

right price, um, to another

publicly traded company, um.

It's a lot less stress than

taking a company public.

Paul: So doing this six times,

I, what is it about you that

keeps you, keeps you going and

Tamara: Yeah.

Well I'm not doing startups anymore,

so I'm not aging as quickly.

Uh, which is great.

Uh, not to say that it isn't fun

'cause it is addictive, right.

So, um, getting into that.

Grind and, and being able

to get a company going.

And I, I always was, you know,

focused on revenue right.

And go to market.

Um, which I think is the most fun.

Um, I, I don't know that, you know, the

engineers who have to deliver the product

and change it and fix it when it's broken,

um, I feel like that's more stress.

But a lot of people think the

revenue side is more stress.

But for me, I think getting the

product in market and, and generating.

Money is more fun than writing code.

Paul: Yeah.

And, and when did that, when did you

first discover that that was the fun part?

Tamara: Yeah, I don't know.

I think being in sales and being able

to, you know, talk about what the

product does and the success it can

have depending on, I mean, the first

company, um, startup I [email protected]

and it does email like people don't

know that people thought we were

like a, a marketplace for software,

but it was actually email and.

When I told my friends, I'm

gonna go to work for this email

company, and they're like, why?

And because everybody's gonna have

personal email and they're like.

What we have voicemail.

I mean, I know it really ages me

to say that, but I'm like, no,

I think people are, this is the

direction people are gonna go.

You're gonna have a personal email.

Now, how many of us all have five

personal email addresses, right?

Yeah.

Um, maybe more, you know, depending

on, you know, what your, what, you

know, you have one for junk, one

for real stuff, one for your kids.

Um, so.

It, it surely that that

did end up working out.

But I, I do know, my friends

kind of laughed at me and I

thought, I can easily sell this.

This makes sense.

Um, because back in the day you

would have to have long email address

extensions on your email address.

'cause at the time Microsoft would

only allow, I think it was 5,000.

I could be wrong.

It's so many years ago.

Um, 5,000 people under a single domain.

So you had to be like

Tamara at Dallas dot.

x.com.

Right.

So you had to, you couldn't

just be tamara aol.com.

Yeah.

Or Tamara, whatever.

Um, and so these guys came out of UCSB,

they found a way to, you know, put

millions of addresses on a single domain.

Um, they were, you know, brilliant.

I thought this is a great idea and.

You know, no one else thought it was

that great of an idea at the time,

um, which is why it worked out.

You know, you can pick 'em.

So I still like that part of it.

I knew I could get in

and sell the software.

Love the founder, John McFarland.

Amazing.

He actually started

Sonos after software.com.

So the guy's definitely

a repeat, uh, genius.

But um, yeah, I like to get in and sell

things that are fun, that make sense.

So, and that's how I invest too.

So I always look at something and

say, is anybody gonna buy this?

Like, and who?

And then how many people

are gonna buy this?

How many companies are gonna buy this?

What is the addressable market?

If it's big enough, you'll succeed if

it's not, probably have a short life.

Mm-hmm.

Paul: And, and what do you think

it is about you that just like sees

something and says, I can sell this.

Tamara: I don't, I, it's, I

tend to invest in things I like.

Paul: Yeah.

Tamara: So if it makes sense, you

know, if it takes me somebody a really

long time to explain it to me, it's

not to say they won't succeed, I just

am probably not the right investor.

Right.

It's gotta make sense to me.

And I'm, you know, I'm, over the years

I've become fairly technical, so it's

not like I don't understand tech.

But, um, you know, I tend to.

Look for things that people wanna buy.

Paul: Yeah.

What makes you think I like that?

Tamara: Um, I think if somebody

can explain to me, we just

invested in a company recently

called sio, which is amazing.

Plaintiff tech.

So lawyers buy it, right?

Mm-hmm.

Legal, um, law firms buy it and it

speeds up the process to help them.

Um.

Understand what the, the settlement could

be, what the court case is gonna look

like, what the outcomes are gonna be.

So it takes in a ton of data, um, and

it helps the lawyer make a decision

on, you know, how to try that case

if you will, or go, go to, and a lot

of times plaintiff laws settle too.

So you have to understand what

you're trying to sell for, what you

know, if it's a medical, you know.

Toward whatever case it is.

You have to determine kind

of what that outcome is.

That makes sense to me.

There's a ton of data.

Yeah.

You have to understand all of the

outcomes of the other cases that have.

Gone to court before so that you know

what you're, you know, advising your

client of and how you're, you know,

negotiating with the other side.

Um, now you can use AI

to speed that process up.

They have all the data.

Um, the, the system works amazing.

The trajectory is crazy

as far as their traction.

Um, so it was like, okay,

this makes perfect sense.

Right.

If I was a lawyer and I was a

plaintiff lawyer, I could easily

start using this software and just

change the game is how I go to market.

Um, so that's how I make a decision.

I look at everything from that

perspective of who's using it and how

are they gonna make money using it.

Paul: And is, is there a process

to that or you just get it?

Tamara: Um, there's always

a, there's always a process.

Yeah.

Um, I look at it, I said

it like a Canadian process.

Mm-hmm.

I'm American process.

Right.

You've been here long enough.

Yeah.

Well, my dad was Canadian,

so I can flip back and forth.

Um, but.

You know, I, I think we

do a lot of diligence.

I mean, we we're so lucky because we

can use our internal teams, right?

Our engineering teams and, and our labs

teams and, and they'll take a look at

things for us to tell us, you know, what

does this look like and what do you think?

Um, and a lot of times we look

at tech for internal use as well.

So if our internal team takes a look

at it and they think it's valuable, I

mean, we have a lot of engineers at,

at Thomson Reuters, so we're lucky.

Um, we can get a pretty good

answer from them as well.

Paul: Yeah.

So no one's sitting there

thinking, oh, you're crazy for,

Tamara: no, for doing

Paul: this now.

They're like, okay.

Tamara: No, I mean, we look even

internally for our engineering teams and

our sales teams, if they cut, if they

see something in the market that their

customers are buying, their customers

are looking at, you know, they'll call us

and say, Hey, have you seen this company?

Or have you, you know, looked at this?

So we, we get leads from

them, which we love.

Edwin: Um, I mean, it's amazing.

I appreciate your story and, and it's

such a colorful background, where you

come from and all the experience, personal

experience you have, and, and as much as

it may not come in, I mean, it, it comes

innately to you, but all that wisdom

that you have just from being within

the operator and allowing to provide it

and really just now looking at the data

and what would make sense and, you know.

What comes to you naturally and you

sometimes you don't realize that

talent you have in terms of like doing

that and you get the vast amount of

abundance resources at Thomson Reuters

to really help you really like.

Validate what you're looking

at and do that type of stuff.

So before we end, I'd love it if you

could, you know, just to put you in the

right mindset and context, you know, we're

sitting here at Web Summit Vancouver.

You are seeing, you and your

team are seeing amazing startups.

You mentioned earlier,

innovations, people who might.

You might think they're crazy, like

there's no service here, but I'd love

it if you could just share any like,

thoughts, recommendations, or any

advice to be a founder, CEO or even the

business leaders who are listening today.

Tamara: You know, you, you do

have to simplify your message if

you want people to understand it.

So I, I would say that.

As a founder, and a lot of these

meetings are 15 minutes, right?

Mm-hmm.

So you're, you're going and you're

meeting an investor, or you're meeting a

potential customer that you can sell to,

um, get the message across quickly, right?

So that they understand what you can offer

and how does the product work, right?

You don't always have time

for a demo at Web Summit.

Sometimes you do, right?

And if they can quickly show you

something, that's even better.

But I would say simplify the message

so people understand what they're

buying and why it's gonna benefit them.

Um, and hopefully in that 15

minutes you can get some good leads,

Edwin: right?

Yeah.

And it's important.

The one thing I just want to add on to

in terms of how, how you explain that is.

That's the elevator pitch.

Like, yeah, there's no time

to give the demo, right?

Like, right.

And the demo's actually the follow

up could be the follow up, but

that's when they're interested.

Now they, oh, you, you caught my eye.

I heard something that, and I'm sure

this is what, what goes through you.

It's like, okay, let me see what you have.

Yep.

I'll give you another two minutes.

Exactly.

Basically like, we'll, we'll

go up another three floors and

we'll, we'll, right, exactly.

We'll, we'll talk about that.

Show me your demo.

Tamara: Because they're

looking at so much.

So you gotta find a way to be

succinct and differentiate.

Edwin: That's amazing.

Um.

We want to, we, we wrote this book called

Future Narrator last year from Collision.

We interviewed VCs, founder CEOs,

and people who are really helping

build and do the whole innovation.

So we, it just, we just

released so Awesome.

We just want present it to you.

Thank you.

And we excited, we hopefully that, you

know, motivates you and the people you

work with, all, all your portfolio because

we believe that it's, as you say, in terms

of the elevator, it's all your vision.

But now with the world of ai, um, not

everyone, but a lot of people could.

Build a product very quickly, but

now it's the, it's the mission.

It's the responsibility of the

founder to really have that story.

What is the world that we're creating?

Because when you have a very good story.

It's easy to get stakeholders, investors.

Yep.

It's easy to hire people,

it's easier to get clients.

So when you have a clear vision, and this

was sort of what we were learning and

what we've been doing over the last 10

years in terms of helping founders and

CEOs, we want to present that to you.

Tamara: Thank you so much.

It's been great.

I look forward to reading

this on my long flight home.

Edwin: Amazing.

Well, tha thank you for joining us

on the Business Leadership Podcast.

Tamara: Thanks so much, guys.

Thank you.

Really appreciate it.

You are listening to the Business

Leadership Podcast with Edwin.

Creators and Guests