Revolutionizing Credit Access for Small Businesses with Ruby Loans

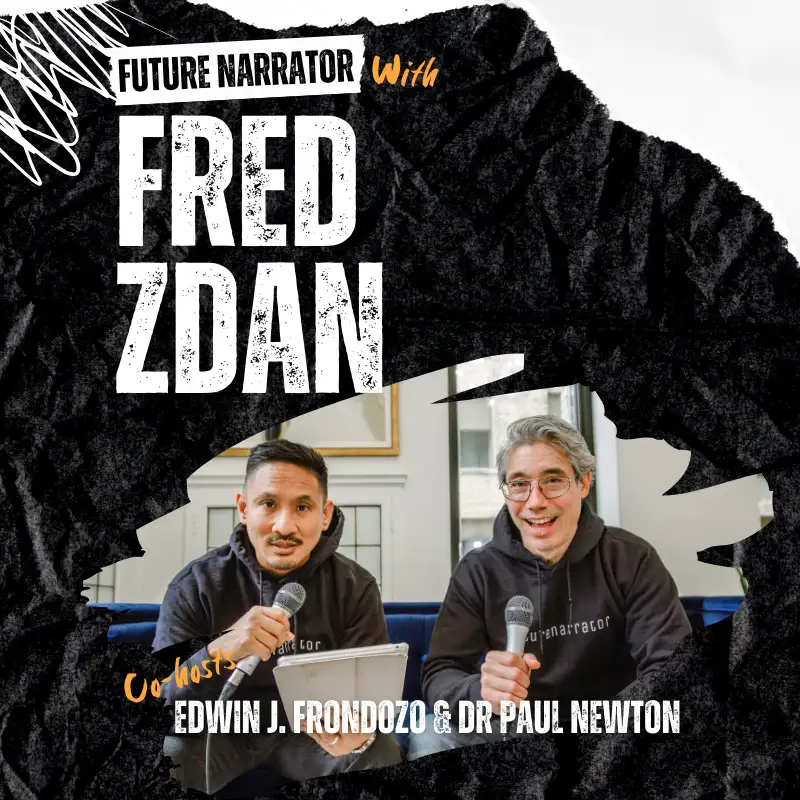

You are listening to the Business

Leadership Podcast with Edwin.

Paul: Today's guest is Rethinking

Small Business Lending by rewiring

the lending process for the AI era.

Fred's Den is co-founder of Ruby Loans,

uh, platform designed to streamline and

modernize the small business loan process

through AI powered borrower interviews

and real-time credit risk assessment.

With over 30 years of experience in

financial services, Fred brings deep

industry insight to the challenge

of transforming a paper heavy.

Labor intensive system into a seamless,

borrower driven digital experience at

a time when SME lending remains one of

the most underserved and inefficient

segments in the financial services.

Fred and his team are building the tools

lenders need to scale while empowering

borrowers to take control of the process.

Welcome to the show, Fred Zan.

Here you go, Edmond.

Edwin: Thanks a lot, Paul.

Fred, first off, welcome to the

Business Leadership Podcast.

Welcome to Web Summit Vancouver.

Super excited to have you.

I just start off, how,

how are you doing today?

Fred: I'm doing great today.

Thank you very much.

How are you enjoying the show?

It's been, uh, thus far.

I've been terrific.

Edwin: Oh, amazing.

Amazing.

I guess let's just jump right in.

Sure.

Fred, if you could tell us and share

with us more about what Ruby Loans is in.

Specifically, what are the problem you're,

you're looking to solve within the small

business lending and financial services?

Fred: Okay.

I think I'd rather start

with the problems first.

Yeah.

Set the stage.

Yeah.

No, I love that.

So the industry that, you know, supports

small business lending, uh, has been

through tremendous change over the years

and small business lending or credit

granting for small business is one of

those areas that hasn't really evolved.

And the process that.

Most traditional lenders are

engaged in is very labor intensive.

It's very documentation heavy, it's very

time consuming, very inefficient and is

not a a customer friendly experience.

So it

Edwin: sounds like old school still.

Fred: It is,

Edwin: yeah.

Fred: Without trying to offend anyone.

It is very

Edwin: much old

Fred: school.

Yeah.

And a lot of that is also because many,

the individuals involved in that process.

Are also aging out.

Right.

And there hasn't been a, a really

strong emphasis on success succession

planning or changing the way they do

business to meet the changing market.

Edwin: Mm.

Got get, 'cause the market

Fred: is also changing.

Mm-hmm.

You know, 90% of business

in Canada are, are.

Uh, small business, right?

And that industry is growing very quickly

and it's a challenge for those business

owners or credit seekers to even access

Edwin: right,

Fred: small, uh, small business credit.

'cause they may not have a relationship

in place with, uh, a traditional lender.

So that's kind of sets the stage

for why the timing is right, we

think for Ruby loans to, uh, to

change or disrupt the market.

Edwin: Oh, that's amazing.

Um.

I guess when it comes to what we are

curious and what we're passionate about,

Fred, I'd love it if you could just

share what your unique point of view

is and what do you, you and the team

bring, and specifically you as the bi,

as the leader, you know, to this problem.

Fred: Okay.

I've been, I've spent about 30, 30

plus years in, uh, this industry.

Yeah.

In various capacities.

I've been in, uh, you

know, in credit granting.

I've been, uh, executive

responsible for credit granting.

I've also spent the last part

of my career in, in consulting

services to financial services.

And I, I spent a lot of time.

In, uh, operational

effectiveness and efficiency.

Mm-hmm.

And in fact, the genesis for Ruby,

Ruby Loans actually came from a

client discussion about five years

ago saying, wow, there has to be

a better way for us to do this.

So my point of view is that

we have to find a better way for the

industry to a gather, uh, new leads

and new opportunities in this segment.

But change the way internally that we,

uh, operate this segment so that we can

be, you know, more efficient, uh, more

effective, be more customer focused.

Mm-hmm.

Um, and, uh, uh, prepare us for,

or prepare the industry for.

What's coming next,

including open banking.

'cause that's also a very big piece

of what is coming down the pipe.

Edwin: Yeah.

To actually, I mean just, just for

the benefit for our audience and even

myself and Paul, like when you talk

about open banking, like what does

that mean to let, let's not just say

that the industry, but what does it

also mean to the small business owners

and, and, and how will that benefit?

And, and I'm really like, how

different will that create?

This experience for us as a us me, I'm a

small business owner, you know us as well.

Okay.

Fred: So that's a great question.

Yeah.

And I think that's really where,

you know, uh, where, where

all of us need to be thinking.

But um, right now in the traditional

space, you have a relationship

potentially with a lender or a bank

or a credit union or a trust company

that you would go to to seek, uh.

Credit or, or your, your business needs.

Mm-hmm.

Financial needs in, in the

open environment, open banking

environment, that relationship

doesn't necessarily exist.

Mm.

Because you then have the

opportunity to access.

Uh, on a much broader base mm-hmm.

The services that you need.

And so that relationship with

your lender or with your bank

suddenly starts to diminish

Edwin: mm-hmm.

Fred: Yeah.

And becomes much more competitive

for the landscape, for the business,

for the lenders themselves.

Edwin: Oh, wow.

So tell me, and then I'll,

I'll, I'll let Paul jump in.

Um, so when it comes to Ruby Loans

and the solution that you're not

only developing but bringing to

market, how does that really reflect?

Back to your point of view, your POV,

the way you look at the industry.

Fred: Okay?

So what I didn't talk about was

what is review reviews, right?

And I really should do that.

Mm-hmm.

So what we've done is, is

we've changed the dynamic from

being a lender driven process.

Mm-hmm.

Whereby if you apply for a loan as

a small business owner, I mean, not

that different from a, from a personal

situation, the lender is driving

the process with you to provide them

with the information that they need.

Mm-hmm.

To do that assessment of your credit risk.

Mm-hmm.

Or your, your, your, the

strength of your borrow position.

Yeah.

So what we're, what we've designed.

Is rather than me waiting for a lender

to drive the process myself, as a

small business owner who's looking to

seek credit, I initiate the process.

Mm.

So I go to, uh, the Ruby Loans web link,

and I start, initiate an inquiry process.

Mm-hmm.

That generates with the assistance of

ai, a validated, uh, uh, uh, verified.

Inquiry for the lender.

Mm-hmm.

The lender receives that and they

know that it's come through this

process that has verified it for them.

20 minutes, 20 questions is what

is what we're talking about.

Nice.

Yeah.

That's our, that's our tag.

I like

Edwin: that tag.

Fred: And, uh, the lender then knows

that whether know immediately if

there's enough to go to an application.

'cause the application is

the meat of this process.

Mm.

It's, it's where all the information

is gathered and evaluated,

assessed, uh, put into some.

A format that the lender then

uses for a credit approval.

So if I generate the inquiry as a

borrower, then I go back in, uh, with

the authorization from the lender

to say, Edwin, we know would like

you to provide us with all of this

information that we need, uh, to, so

that we can prepare the application.

Edwin: Right.

Yeah.

So again, it's

Fred: back on you as the borrow.

Edwin: Mm-hmm.

Mm-hmm.

Which

Fred: again, frees up time

and effort of the lender.

It engages the borrower in the process

and it, um, you know, uh, eliminates

much of the time and effort that

the lender is spending because if

they have more than one of these

going on at once, which they would,

Edwin: yeah.

Fred: You can appreciate that.

It's a very, uh, circus-like

environmental times.

Edwin: I can't even

Paul: imagine.

I can't even imagine.

So, so Fred, like, why do you,

why do you care about this?

What, what really drove

you to change this process?

I.

Fred: You know, I've seen, I, I've seen

and felt the pain, and I know from talking

to clients even now and potential clients,

they get it.

They know they need a solution

to change the way they operate.

Mm-hmm.

They know that they're

facing increased competition.

They're struggling to reach the

market that is growing because if,

if they're people younger than me who

are looking for credit and running a

small business, I don't have the time.

I think to go in and spend my

time, multiple appointments,

phone calls, et cetera, et cetera.

So there's a, an appreciation I

think that, that we need to change.

Mm-hmm.

And, um.

I, I just find that really invigorating

that we could be part of that solution.

Paul: And, and so you've seen it on,

on both sides, like as, as in seeking

the credit or just providing, or,

Fred: it's funny you say that.

'cause I have, uh, when I ran

my consulting practice, and I

won't say who I was dealing with.

Yeah.

But we did have to go for, you

know, for an operating loan and, uh.

It was a, it was a very challenging

process to get, get through, and

it was not like we were looking

for an exceptional amount of money.

Mm-hmm.

But, um, and if you, you know, it's funny,

I met somebody this morning on the way

in and they asked what I was doing and,

and what we do and he said, you know, I'm

a small business owner and I just went

through a whole, very rigorous process

for a very simple operating, uh, facility.

And I don't understand why,

why it has to be that way.

So.

I think there's a lot of

validation in the market.

Paul: Yeah.

And I guess all the, all the time

you spent in, in the industry

and seeing it from all angles.

Um, you know, so what, um, I mean,

you said you, you're taking a paper

heavy and like cumbersome process.

Mm-hmm.

And now, now that it's super

straightforward, easy 20 minutes, like

what does that look like for, for SMEs?

Uh, like what, what do you think

is gonna change 'cause of that?

Fred: I think a, having the access.

To a process that won't be reliant on me.

Having a relationship with an

individual or, or a, or a perspective

or a particular lending institution

is a big thing because if I'm a small

business owner, uh, and I've got a

million things on my plate, I may not

get to this till 10 o'clock at night.

As an example, I know that I could, with

Ruby Loans, I know that I could go in,

start my process, however it suits me.

And I think having that access

is, is really a game changer.

Paul: Well it is really offering this

potential of growth and, and, and

just, you know, ability to, to take on

challenges to these, these businesses.

Fred: Right.

And for the lenders as well, because

it gives them a new opportunity

or, or a, a different opportunity

to gather new business leads.

Paul: And then the whole

relationship really changes.

'cause that that dynamic of the, you

know, of the power really, uh, is

Fred: the power shift or is it that

I'm now engaged in my own process?

Because in the, in the

traditional approach, the

lender is driving the process.

I'm waiting for the lender to get to me,

to ask me for the plethora of information

that they're gonna need from me.

And then they say, oh, and

by the way, we need it.

By now.

Yeah.

Yeah.

Versus if I'm driving the process, I

can say, okay, I will get that to you.

Or I can have my, my, my business

resource get that to you.

And we've designed this so that

it's any format, any, uh, you know,

just get it to us electronically

whenever format it's in, because our

engine can read anything at this.

Edwin: Yeah.

That, that's amazing.

Thank, thanks for sharing all that, Fred.

And when, what we're looking for and

the, the missions and the visions

and the stories and specifically

the future of, of the founders.

When we talk about future narrative,

I'm really curious as what do you see,

um, what, what does the future look

like when Ruby Loans is there providing.

The small business owners a

very quick loan operating loan.

Like, like how does, what's

the impact that it creates?

Let's

Fred: not say it's a quick loan.

Okay.

It's not quick loans.

There's still a very

thorough process Okay.

That the lender is, has to go through.

Sure.

But what the difference is,

is that customer experience I.

Really increases.

Mm-hmm.

I mean the, or the, the,

the, uh, the customer, uh,

friendliness of that experience.

Okay.

Definitely increases.

I mean, I think the opportunity

for a lender to create a new

relationship with the small business

because of the pleasantry of that

experience is a real positive.

But I think as well, just the

support of a small business for

a small business, knowing that.

I have the access mm-hmm.

To at least start this process.

Mm-hmm.

Um, without the going

through the traditional

method.

Edwin: The method is Yeah.

I

Fred: think the key.

Edwin: Yeah.

And what, what does that mean

to, to those entrepreneurs?

Like what does their world look like?

Is it because, and I'm just talking

from my own experience and maybe all

of our experiences being consultants,

small business owners in the past, um.

Does it allow, and I don't wanna, I don't

wanna put, you know, the words in your

mouth, but does it allow when in the

future, I know as an owner I'm like, oh,

you know what, that's, that check mark is

actually easier to do now versus like an

overwhelming like mountain to even start.

Fred: Well that's a, that's

a really great point.

And you know, this isn't changing

the world of credit risk assessment.

Mm-hmm.

This is not changing the way that

lenders need to evaluate credit risk,

Edwin: because that can't change.

That doesn't, well,

Fred: that, that's really

dependent on a lot of variables.

Right.

Who, who the lender is, what their

requirements are, what their policies

are, what, how they're regulated.

I mean, there's a whole underpinning

of policy and compliance

that they need to maintain.

Right?

Right.

But what it does provide,

I think, or we think is.

The access mm-hmm.

And the ability for the small business

lender to seek it much easier.

Paul: So, so you're, um, you're

providing a solution to lenders Yes.

All over to, um, to do this.

So you, I mean, you, you're changing,

you're changing things on, on both sides.

Right.

Then

Fred: we are B2B, we are

intending to be B2B at this point.

So our client at this point is a lender.

We don't see providing this necessarily

at this point to the open market

where B2C, where we could then.

Feed opportunities to a lender.

That's, that's not on

our radar at this point.

We're B2B,

Edwin: it's not like a B

two, B2C type of operation.

Correct.

Right.

That's correct.

Paul: And, and then earlier you

were just telling me like, you, you

guys are really well connected and

you're just waiting to, uh, to get

things to, to get things out there.

And, um, so, and I mean, I'm just thinking

like, so you, you know, that there's

something really new you're bringing

to the table or, and you just wanna.

Yes.

See it, um, starting to take hold.

Yeah.

Fred: Hope Business partner,

uh, his name is George Hink.

He and I both have fairly extensive,

uh, contacts and, and, uh, connections

in the financial service industry in

North America, and we've spent a lot of

time talking this up, uh, and canvassing

our connections and potential clients.

Mm-hmm.

To say what if.

And we did an exercise last fall, uh, at a

conference that, that we were both at and

took the time to invite selected contacts

of ours who were going to be there to

say, can we have tenancy of retirement?

Just talk about what we're thinking.

Mm-hmm.

And the feedback was tremendous.

It was, you know, a number of

'em said, when can we have this?

So, and some nuances on that

too, because working within, um.

And because of the technology platform,

using it internally as a, as a process

versus not just being external helps

organizations be more efficient,

helps 'em with their training and

succession and all that good stuff.

But even working in, in multi

uh, multi uh, um, language.

I can't think of the the word, but you

know, if I'm working in a, in a segment

of the market where I'm not speaking

English, that's my first language.

We, we could translate that, you know,

and have it much more accessible or

readily available to that, um, unique

market and break down some barriers.

So that was a, a really neat,

uh, uh, outcome of that session.

Well,

Paul: you really, you really are

providing a lot more access to mm-hmm.

To something that was cumbersome and,

and it's just, with ai it's, it's

offering, uh, so many different ways

to improve that customer experience.

So, um, it's, it's great to see how,

uh, just all the industry experience

that, that you bring, um, at this point

in time can really reshape how, how

loans are, are being applied for and

making that experience customer centric.

Edwin: Um, Fred, just before

we wrap up, I'd love it.

Um, it might be a, a two-prong

approach, but I'd love it if you could

first off, share any advice or final

thoughts for those who are listening.

And the, the context I kind of want to

put it is not only as a startup, um.

You know, the importance of you

to tell your story at events

like Web Summit and, and why you

felt like coming here was really

important for you and your platform.

Fred: I think one of the things I've

been really focused on is making

sure I knew what I was talking about.

Mm-hmm.

And I've done a, George and I have

done a lot of research and a lot

of DI engaged, lot of dialogue.

To make sure that we were bringing

something forward that not only

had value but meant something

to the potential customer.

And I've, I've really tried to

focus on that and, you know, it's

really easy to get carried away

with the technology and how mm-hmm.

Finding exciting and innovative this can

be, but if it didn't solve that problem.

I, I think that's, that's been

key for me all the way through.

Stay focused on the problem.

Edwin: I, I love that.

And, and the one thing, but before we

let you go, Fred, and I just wanted to

really, really ask you, you talked about

this conversation to get the language

correct, so you're telling the story.

Um, how was that important?

How did you and George do this?

Was these internal conversations,

was it also being within conversation

with clients and community?

Fred: Personal.

Yes.

To all the above.

Yeah.

One, um, we, we spent a lot of

time together, uh, again, 'cause

we've got a really, uh, diverse

but yet intersected backgrounds.

Mm-hmm.

Um, but largely was with,

uh, trusted connections.

Okay.

Uh, who, who, who will become clients.

I'm pretty convinced of that.

Great.

Because relying on them to tell us that.

We were valid in what?

In what we were saying or thinking

Edwin: was

Fred: key.

Edwin: For Airbnb.

That's awesome.

Well, Fred, this is amazing.

I hope you the best of

luck on uh, Ruby Loans.

We're excited to see you know, this, just

as business owners streamline help us

as well as the B two, B2C type of view.

But, uh, thank you for joining us

on the Business Leadership Podcast.

Fred: My pleasure.

It was great.

Thanks guys.

You are listening to the Business

Leadership Podcast with Edwin.

Creators and Guests